They appealed to a farce that had begun in 2016. “The Executive Board of the IMF concludes the Article IV Consultation with Argentina” (November 10, 2016). So, with the IMF conspiracy, that more than ensuring the macroeconomy, the fulfillment of goals and quantifying urbanities, It was becoming more flexible to ensure that disbursements continued to arrive so that the swallow capital could escape. Also so that Macri does not fall and Peronism wins. The IMF continued to deepen the mess of that tragic government, paying with the money of the plumbers and carpenters. The resource “carpenters and plumbers” belongs to Paul O’Neill, Bush’s United States Secretary of the Treasury. He said that with a financial bailout those two unions, which embodied the average American, they would pay for the irresponsibility of those who lent money to Argentina and those who took that money. They reappeared to do it.

The convictions of Peronism, even if the FDT is in disarray, is a huge inconvenience for the cruel adjustments and the inhumane appeals of Lopez Murphy. Even with a complex macro and organizational mess inherited from macrismo and those peripheral accomplices, plus the pandemic and the war; The debt in pesos continues to be renewed and the exchange situation is controlled. The “devaluation club” does not give up its attempts, nor is there any hope of “quit”. When they talk about being honest, they talk about causing chaos, which the government has been avoiding. There is no doubt that the neoliberal monster will want to take advantage of the vulnerability of the economy.

The opposition has all the tools in its hands to generate a run on deposits and confuse debt renewals to push for a fatal outcome. And the ruling party is going to fight it, even in an election year, it will try to avoid maneuvers with excessively limited supplies. If you arrive safely, but the yellow calamity returns, you will make all the adjustments “the same, but faster”, paying a political price close to that of the helicopter, “the same, but faster”.

After the opening of the Ordinary Sessions of Congress, a collaboration pact between the Government and the opposition does not seem viable to prevent the visceral anti-Peronist front from pursuing a crisis and trying to spiral it out. In any case, they will not have it easy, the Government can reach the STEP, and Peronism can prepare to fight politically.

If the anti-Peronism wins, we will see the start up of the fierce adjustment and its early bankruptcy. As soon as it assumes the grotesque that is displayed, it will try to unify the exchange market by devaluing and unleashing hyperinflation by the “pass through” or price correction. Rates are going to skyrocket, generating an extraordinary recession.

For the debt contracted by the government of Mauricio Macri, Prat Gay, Sturzenegger, Dujovne and Caputo, https://www.ambito.com/opiniones/debate-la-deuda-publica-cronica-un-default annunciado-parte-iv -n5663391 the country lives in a brittle context of financial instability that raises the risk and the pretext that the possibilities of chaos happen or are intentionally established.

The Cambiemos government was favoring the insolent management of financial instruments with interest in extravagant pesos in Lebacs/Leliqs, and in dollars, at rates 4 times higher than the left-wing populist government of Evo Morales. Always far from solving the problems, they made the dollar explode in the PASO and irresponsibly tried to move its impact to the day after the October 2019 elections.

In 4 years of Macri, the debt-to-GDP ratio had increased from 52% to 98% in December 2022. Today, that ratio experiences a decrease of 12%, reaching 77%. The best thing is that there is also a de-dollarization of the debt. The dollar debt ratio fell from 70% in 2019 to 52% today. The Treasury rate is 0.65% per year and the Treasury rate plus the BCRA rate averages (-6%).

However, the insane antagonistic hatred plays for the Government to have financial difficulties and the economy to explode to win the presidential elections. To the dismay of the opposition, in the last tender the Government placed $345 million and obtained net financing of $75 million, fresh money for $182 million in February.

The only thing that is certain is that if JxC wins, it will default on the debt in pesos again, as Minister Lacunza did in 2019, after the resignation of Minister Dujovne.

A non-aggression pact turns out to be difficult. The most likely thing is that the debt with the financial system will continue to be renewed, which, unable to invest in dollars, has no other choice. You must continue buying public securities, until the end of the mandate.

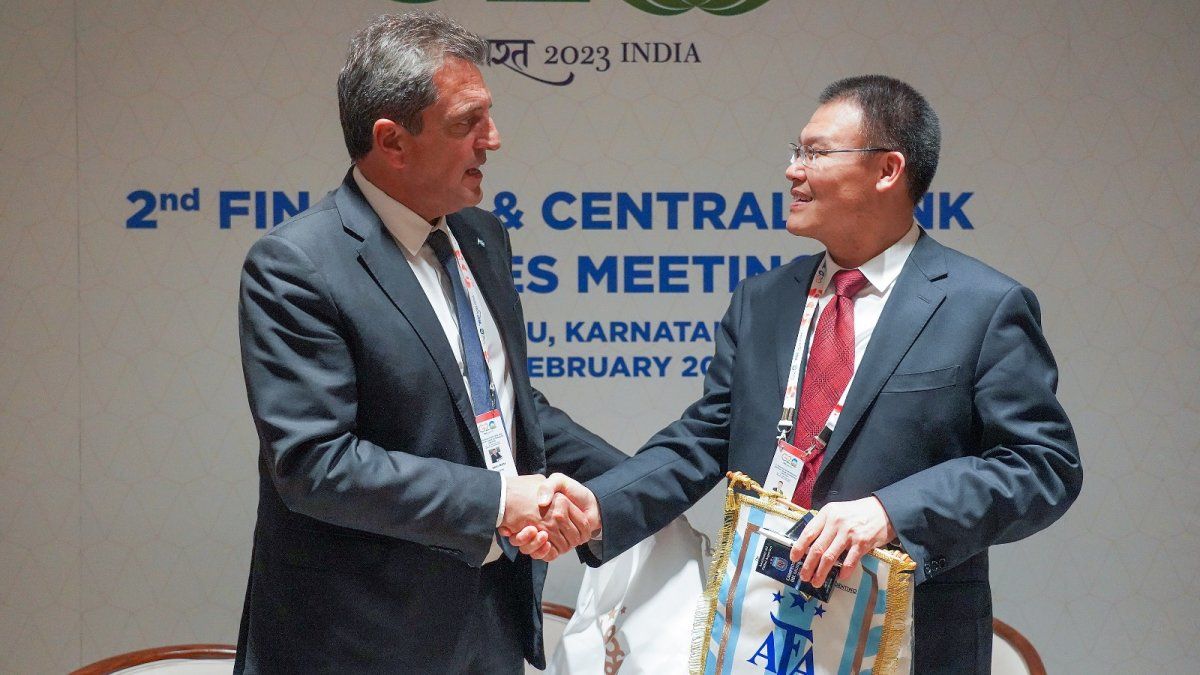

In another order of hostilities, the exchange limitations are taken advantage of by the exporters, pressuring Minister Massa, so that he returns to give them a dollar with which they feel satisfied. For now, they are not twisting his arm, because the restrictions on imports will be extended and he is making progress with a surprise swap with foreign banks. The IMF aims to reduce the next quarterly goals of net reserves, considering the minimum inflow of foreign exchange arising from the deterioration of the circumstances of agriculture.

The program with the IMF failed from the outset with Macri, knowing the IMF. That monstrosity resorted to creative accounting and various devices to simulate formality, with which the goals never transcended as real quantifications of the corrections that Macri had to make to reduce the imbalances. The fiscal and reserve figures were directly adapted to reach the end of the mandate, with the connivance of the IMF so that the disbursements would continue facilitating the dollars for the flight and the time so that the Macri government does not fall like Fernando De la Rúa. If the IMF wants to continue collecting payments, it is deepening a mistaken economic policy orientation in force in all the disasters that it has always produced in the country. The aggravating factor today is that Argentina has a huge proportion of its credit portfolio that can make it limp. Finally, the IMF continues to increase the chances that the next government will begin its mandate unable to meet the original and even refinanced commitments.

“I’m right, and I think I’m saying it right, if I say that it’s good enough to see so many inept fools sell, the truth is that the garden is for those who work in it…” (The saga continues).

Graduate Professor UBA and Masters in private universities. Master in International Economic Policy, Doctor in Political Science, author of 6 books. @PabloTigani

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.