During the first months of 2023, the markets had an auspicious start to the year, largely supported by improvements in the real economy. In the United States, the GDP closed 2022 with favorable growth data, despite the monetary squeeze by the Federal Reserve.

Strictly speaking, the first world economy grew 2.1% last year, above market expectations, and the 1.7% expected by the FED. This expansion was based on consumption, with a very solid employment market that created more than half a million jobs in January, well above the 189,000 initially expected.

In short, signs of a much stronger economy than expected, considering the aggressive tightening by the Federal Reserve by raising interest rates by 4.5% last year. Regarding inflation, applied medicine had its results: eight consecutive drops in the price index from the maximum of 9.1% year-on-year in June, to a current 6%.

However, core inflation remained persistent at levels of 5.5% – 6%. For the market, this could signal that the structural factor of inflation will be more difficult to overcome, and that it could require even more contractionary monetary policy.

In their speeches prior to the fall of the SVB and Credit Suisse, both the FED and the European Central Bank reaffirmed the idea of further rate hikes, and maintenance of these monetary policy references at higher levels, and for periods of time longer.

The impact on the markets

In early March, the market expected a 50 basis point rate hike from the Fed at this week’s meeting, and a rate to 5.5% by the end of 2023.

Following this, the inversion of the US Treasury yield curve deepened to historical levels. He “spread” of rates between the 10-year treasury bonds and those of 2 years of maturity marked a negative record that exceeded 100 bp. These spreads have not been observed since the 1980s under the command of Paul Volcker before the Federal Reserve, where said spread fell below negative 200 bp.

The importance of monitoring this indicator lies in its predictive power of the future of economic activity. In the past, when the curve inverted, that is, the differential turned negative, an economic recession occurred months later. A negative level of this depth was indicating present financial conditions that were tightening strongly for a normal development of the economy.

US yield curve inversion deepens

image.png

Source: Criteria based on Bloomberg

Does the fall of Silicon Valley Bank … put a stop to this dynamic?

On March 10, tensions in the US financial system led to the bankruptcy of Silicon Valley Bank (SVB). In addition to setting off the first alarms about the health of the US financial system, the news brought enormous volatility, infecting the rest of the financial assets and deteriorating the mood of the market.

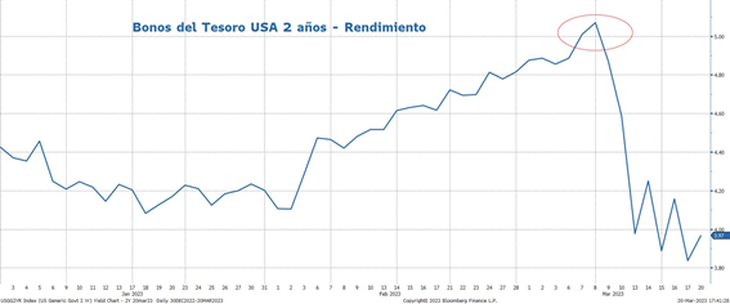

Faced with this situation, the market turned around seeking refuge in risk-free assets. On the other hand, the rates on the 2-year and 10-year US Treasury bonds collapsed, settling at levels of 3.9% and 3.5% respectively, a fierce adjustment of more than 100 bp (1%) in the case of the longer term. short, a circumstance not seen since the stock market crash of 1987.

An adjustment in the 2-year bond yield not seen since the stock market crash

image.png

Source: Criteria based on Bloomberg

Regarding the Fed’s monetary policy rate projections, the projections mutated with the same speed and direction. If a rate of 5.5% is expected by the end of this year, it is now expected that after a final rise of 25 bp this week, it will begin a downward path to 4%.

This twist is based on historical precedents. On several occasions, when the FED has tightened liquidity conditions (raise in rates and/or contraction in the amount of money), “something breaks”, that is, a weak link in the chain gives way and produces a reaction that ends up pushing to a credit crunch, completing the job of the monetary authority. The economy slows down or goes into recession and inflation drops to its target level.

Undoubtedly, this additional seasoning in the financial system makes the challenge of the Fed more complex. Expectations that the Fed will increase its reference rate by 50 bp have vanished in recent days. In addition to its inflation objective, in the short term it is necessary to take care of the health of the financial system, avoiding systemic risk.

conclusions

Declining but high inflation and strong labor market data forced the Fed to pursue an aggressive path of further interest rate hikes. However, after the tension in the financial system, an additional challenge is added: avoiding contagion that could create a banking crisis of greater proportions.

What course will the Fed take at this crossroads? We will find out this week at their new monetary policy meeting. History shows us that beyond some finishing touches, the rate hike cycle is very close to completion.

Director Asset Management of Criteria.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.