Stagflation occurs when the economy experiences price increases and, in turn, a drop in the level of economic activity. These two movements can be seen in the North American and European economies, with effects on the rest of the countries.

In the United States, the August price index for urban consumers increased 0.6% monthly, seasonally adjusted, and rose 3.7% over the last twelve months, without seasonality. The price index for all items, except food and energy, increased for the same month, above 4.3% annually without seasonal adjustment.

The United States has different price variation indicators, in which it can exclude certain items and include others. The Food item had an annual increase of 4.3% and energy had an annual drop of -3.6%. There is expected to be an increase in energy globally, so the annual price increase of 3.7% is expected to be higher.

Clipboard01.jpg

Source: North American Bureau of Labor Statistics.

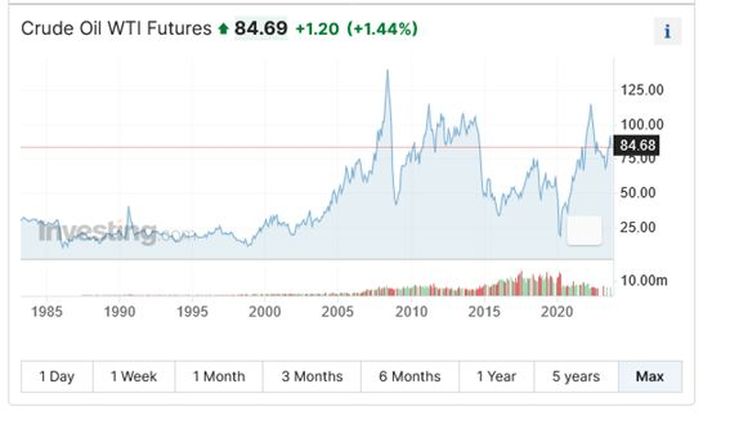

The price of WTI (West Texas Intermediate) crude oil as of October 12, 2023 was USD 84.69. It can be seen in the historical series from 1985-2023, that there were three historical peaks: USD 131 in July 2008, USD 122 in March 2012 and USD 117 in June 2022.

Clipboard02.jpg

Source: Investing.com

Currently we are witnessing several factors that will determine an increase in energy globally:

1- War in the Middle East.

OPEC is the Organization of Petroleum Exporting Countries, it coordinates the oil policies of its member countries to influence the international oil market. The member countries of OPEC are: Algeria, Angola, Ecuador, Gabon, Iraq, Iran, Qatar, Kuwait, Libya, Nigeria, Saudi Arabia, Venezuela and the United Arab Emirates. The basket recorded by that Organization is an average of the prices of oil produced by the member countries and is used as a reference point for oil prices. Given the current conflict in Israel, it is expected that producing countries will cut oil production to try to increase the price of energy in response to the war conflict.

2- War in Ukraine.

The International Energy Agency (IEA) estimates that the European Union spent almost €400 billion last year on gas purchases, almost triple the 2021 bill. It is estimated that the fiscal aid applied by EU countries to cushion the crisis between citizens and companies amount to at least 657,000 million euros. Germany alone, a country highly dependent on gas, has allocated 265 billion euros. Although the energy crisis is often described as one of the worst consequences of the Russian invasion of Ukraine, it actually predates the war. It is estimated that 60% of the LNG that Europe will need in 2023 will be in the form of uncontracted volumes from the spot market. This will force Europe to compete with the global market, including Asia, and is likely to result in a reduced market this year. At the same time, food prices are also expected to increase in this scenario, since Ukraine is the sixth largest grain producer in the world.

3- Little energy impact of renewable energies.

Fossil fuels account for more than 80% of energy production worldwide, although cleaner energy sources are increasingly gaining strength. Only approximately 29% of electricity currently comes from renewable energy sources.

4- Arrival of winter in the United States and Europe.

With the arrival of the European and North American winter, greater energy consumption will be needed, so there will be an increase in the demand for fuel. Given the current restrictions due to the war in Ukraine and Israel, there would be a reduction in supply that will produce an increase in the price of fuel.

European countries are currently experiencing price increases. The United Kingdom registers an increase in year-on-year consumer prices of 6.7%, Germany of 4.5%, France of 4.9% and Italy of 5.3%, among other countries in the European Community. The increase in energy globally will have two effects: increased prices and increased spending on energy subsidies. This will produce a recession with increased prices.

In the United States, given the inversion of the yield curve of North American bonds, a recession is expected in the largest economy in the world. These recessions will have repercussions globally, generating a drop in the level of economic growth.

Argentina has the opportunity to develop conventional and unconventional energy resources. In this way it could obtain foreign exchange from greater fuel exports. At the same time, international food prices are also expected to increase, of which the country is a key producer of grains. The large producers worldwide are the United States, China, Brazil, Argentina, the European Union and Ukraine.

Argentina’s trade balance in the Fuels and Lubricants Complex was negative last year at USD -3,571 million, with exports for USD 9,297 million and imports for USD 15,036 million. The increase in fuel exploitation and the increase in its price internationally opens the possibility that the balance of the energy balance will once again be positive and that it can provide foreign exchange for the country. At the same time, international food prices are expected to increase, of which Argentina exported in 2022, in the oilseed and cereal sector, for USD 40,961 million. The current international scenario may be an opportunity to avoid external currency restrictions.

Economist (UBA, UNR)

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.