The new financial solution, unprecedented in the Argentine market, allows obtaining returns with an APR of up to 48%, without a limit on the funds to be remunerated. It is offered by a virtual wallet.

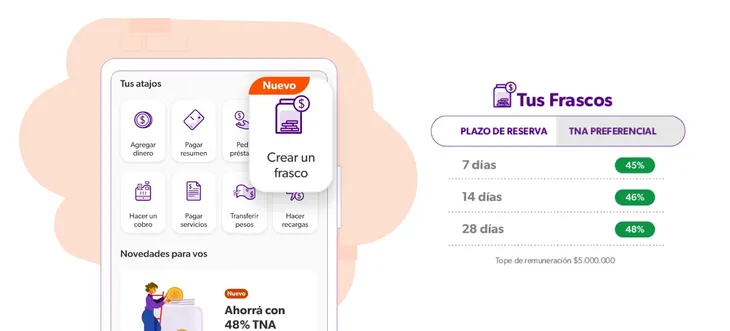

With “Frascos” users can separate their money for 7, 14 or 28 days, and remunerate at a rate of up to 48% annually (or 3.9% monthly).

Depositphotos

While the maximum fixed-term rates are around 40% annually, the virtual wallets redouble their efforts to remunerate the pesos of small savers even better, even betting on defeating the resistant inflation that analysts estimate will not drop below 3% monthly at least this year. But an investment appeared that yields 48% of TNA.

The content you want to access is exclusive to subscribers.

It is not a traditional bank fixed term, but it works in the same way. The virtual wallet Orange X presented “Frascos”a new savings functionality that will be progressively available to all fintech clients during the month of September. It is an innovative financial product, unique in the Argentine market, which “is born from actively listening to customers and their needs to solve their daily economy,” indicated the virtual wallet.

With “Jars” Users can separate their money by 7, 14 or 28 daysand remunerate a rate of up to 48% annually (or 3.9% monthly). The rate drops in a shorter period than 28 days. This way, The 7-day fixed term pays 45%, while the 24-day term returns 46%.

That is, if the forecast of the latest Market Expectations Survey (REM) of the Central Bank (BCRA) is met and September inflation slows to 3.5% in September (from 4.2% in August), The maximum rate offered by the new Orange X solution will become positive in real terms (will exceed inflation).

In the event that savers need their money ahead of time, they can release it from the “Jars” whenever they want. In addition, you can create the number of “Jars” that people want, according to their needs and deadlines, as well as categorize and name each jar according to the financial goal that users have to meet.

“We continue working to bring our clients digital financial tools that allow them to organize themselves and make more efficient use of their money. ‘Frascos’ is a very simple tool and, at the same time, different from anything that exists on the market that allows us to evolve the way in which people save and achieve their financial goals,” commented Juan Ignacio Talento, Chief Product Officer of Naranja

Bye fixed term: how do you create a “Jar” of Orange X?

- Access the button “Create Flask” from the home of the app or within the “More” section.

- Select a category.

- Choose a name for your Jar and enter the amount you want to separate.

- Choose a time period and the rate is displayed.

Orange Jars X.jpeg

“We have designed an intuitive and effective experience that helps people manage money intelligently, step by step. It’s more than a way to save, it’s a way to make your goals a reality with clarity and confidence.”added Talent.

In a challenging economic context, “Frascos” is positioned as a practical solution for those seeking to grow their money and protect it from the impact of inflation. With this new functionality, Naranja X responds to the needs of its clients, who are looking for tools to save, invest and fulfill their dreams, the fintech highlighted in a statement.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.