The financial analyst, however, highlighted that “the causes are being attacked and the consequences are not going back.”

He inflation index for the month of Septemberlocated at 3.5%, represented the floor of price growth in the last three years. Even so, and contemplating the possibility of an increase in cost of feesthe analyst Claudio Zuchovicki raised the next challenges of the economic direction.

The content you want to access is exclusive to subscribers.

“There are two ways to analyze that 3.5%. Seeing the glass half full, you contemplate a lot of quite relevant things that sometimes go unnoticed. Because a year ago we had repressed rates, distorted relative prices and a $350 dollar that was a fiction because you didn’t sell to anyone.“, noted the economist and added: “This is 3.5% improving all relative prices, updating rates, and with a real devaluation caused by the Government of 2%, so real inflation would be 1.5% remaining”.

Later, he acknowledged that this “It is the first Government that is attacking the causes and does not go behind the consequences. There are no price controls, there are no police on the street so that different types of exchanges are not carried out, with rates that did not exist, with a shortage of a lot of products, before there were no repellents, imported products did not arrive, car spare parts.” .

Inflation: warnings from economists

However, Claudio Zuchovicki stated that “if one looks at the glass half empty, remains the highest inflation in Latin America“It’s not that you’ve already resolved it, it’s still a lot.” Interviewed on El Observador radio, the economist asked to observe the rates: “The consensus of economists speaks of a slope adjustment from 20% to 25%but the other day Ricardo Arriazu corrected me somewhat, pointing out that in Argentina, as gas production increased a lot, it is now much cheaper, so the adjustment that is needed could be 15%.”

“I hear a lot of criticism from people who talk about the high rate and the increase in costs. But I had to pay more for ARBA than for electricity and telephone, I received more for the car license plate than for insurance. And in the City it happens I need electricity and gas, they are essential, but what does the real estate tax give me in return? Everyone accuses the high tariff, but no one talks about what the provinces or municipalities do, that is not on the agenda“he concluded.

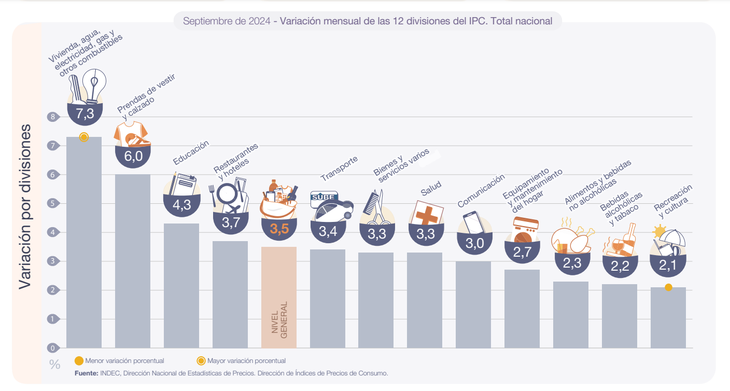

September inflation

The september inflation slowed down 0.7 percentage points (pp) 3.5%in tune with the market expectation and marked its lowest level since November 2021, as reported by the National Institute of Statistics and Censuses (INDEC). He Consumer Price Index (CPI) accumulated 101.6% so far this year and fell sharply to 209% year-on-year (yoy) vs. 236.7% which marked in August.

This way, inflation pierced the key level of 4%, which it could not break since May when it was located in 4.2%. In subsequent months it accelerated and decelerated without a clear trend: June (+4.6%), July (+4%), and August (+4.2%).

September inflation

On the other hand, the Total Basic Basket (CBT)which measures the poverty line, increased 2.6% in September. In this way, youA “typical” family needed $964,620 to not be considered poor.

According to data published this Thursday by the INDEC, both the CBT and the Basic Food Basket (CBA)which is used as a threshold to evaluate indigence, rose below general inflation, which in the ninth month of the year was 3.5%. In order not to fall into destitution, the same family mentioned above, composed of a 35-year-old man, a 31-year-old woman, a 6-year-old son and an 8-year-old daughter, required an iMinimum income of $428,720.

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.