Cedears: does the “Trump Trade” continue for 2025?

The market is discounting, for now, that Trump is going to fulfill his campaign promises, counting more easily on promoting protectionist measures linked to the foreign trade and less ease of promptly implementing fiscal measures, that require greater political consensus in Congress. If this scenario materializes, it could generate a reflationary impact in the US, strengthening the dollar, weakening emerging currencies and commodities, with a Federal Reserve (Fed) that, having taken note at the last meeting the previous week, It is no longer so lax regarding its monetary policy interest rate.

The proposal of tax reduction and economic deregulation benefits the US stock market, while Protectionist policies could raise inflation and slow global growth. In this context, the fiscal front continues to be one of the biggest concerns for the markets.

However, we must wait for greater clarity on the president-elect’s priorities, where the risk of his policies becoming more aggressive is not ruled out, tipping the rest of the world towards a recession that would further widen macroeconomic divergences.

Thus, although in terms of multiples the market looks overvalued, We see a bear market less likely for these reasons, after Trump’s victory in the coming months. However, we are not as optimistic at the index level as the main investment banks who forecast expected returns twelve months ahead of around 10%/12%.

It is worth remembering that No tree reaches to heaven, nor its roots to hell. Taking into account the main reasons in the search for value when managing our Cedears portfolio for 2025, will result in a crucial exercise, contemplating that at the end of this year The S&P500 will accumulate a return of more than 50% in the last two years.

cedars: the 5 key reasons for looking for opportunities at the beginning of 2025

Based on what Trump’s new mandate in the US proposes, and the dynamics observed in the markets in the last two years, we rescue five key reasons in the search for value in our Cedears portfolio:

1 – The Fed initiated rate cuts with inflation slightly above 2%, allowing you to take preventive measures. Although in its last meeting it is no longer so lax regarding its monetary policy interest rate, on the one hand, future declines benefit those stocks whose cash flows are expected in the long term, especially large-cap technology stocks and growth of large capitalization, and on the other hand, if an environment with higher rates continues for longer, this segment is very well positioned with a high cash position and a low level of debt.

2 – Wage increases continue to boost consumer spending, while nominal GDP remains strong, regardless of the discussion about a “soft” or “forced landing” of the American economy, where the latter is losing ground given the good performance of the American economy. Most favorable scenario for the market.

3 – Most households do not have a mortgage and they are benefiting from the enormous wealth effect that has taken hold not only in stocks over the last decade, but also with respect to house prices in the preceding years. Household balance sheets remain healthy, which is positive for the economy and stock markets.

4 – We must remember, as we emphasize for 2024, that we live in a market environment in which Investors are investing in indices. A smaller percentage of trades come from investors who actively manage and pay attention to fundamentals. This should continue benefiting the largest companies in the most representative indices, with large cap technology and large cap growth categories being the most favored.

5 – The performance of 2024, added to that of 2023, gives confidence that 2022 was a passing moment in long-term trends, driven by the rise of Artificial Intelligence (AI), which would also cause an increase in the productivity of the economy with a strong impact on the rest of the sectors and their profit margins. So, AI remains a huge potential source of growth.

The objective when deciding to invest in Cedears should be the long term, and in this sense, the The rise of AI presents a favorable outlook for the rest of the decade. Despite higher rates, the American economy maintains its long-term growth level and if investment causes increases in productivity, inflation can be kept at bay, even with a higher target from the Fed. This scenario reminds he period 1994-2000 in the USAmarked by productivity boom thanks to the Internet, which drove corporate profits and outstanding stock performance.

Therefore, we continue to identify value in technology companies within the large cap and growth sector. This continues to be our favorite segment within a well-balanced Cedears portfolio. The main technology companies in the segment, supported by solid fundamentals, reached record levels of investment in capex, even in a context of high interest rates, which could be maintained for longer.

Two of our favorite Cedears at the beginning of 2025

Considering the reasons that allow us to continue finding value in 2025, Visa (V) and Microsoft (MSFT) They continue to be two of our favorite Cedears with a high participation in our recommended portfolio.

Criteria 1.jpg

So far this year, Visa shares rose 22%, while Microsoft shares rose 16%, both in dollars.

Microsoft reported strong results in its fiscal first quarter of 2025, exceeding market expectations. Revenue grew 16% and earnings per share 10% higher than the previous year. The company highlighted AI-driven transformation as key to its growth, with revenue from Microsoft Cloud increasing 22% year-on-year. In turn, the company returned $9 billion to shareholders through dividends and buybacks, while its free cash flow more than covered its commitments. With a huge cash position and short-term investments, it maintains a solid financial position and strengthens the Microsoft leadership in technology and the cloud.

For its part, Visa also reported strong results in its fiscal fourth quarter, exceeding market expectations. Net income grew 12% year-on-year, while earnings per share grew 16%, beating market consensus. During the quarter, payment volume increased 8%, cross-border volume grew 13%, and processed transactions advanced 10%, all in constant currency. Visa in turn returned $6.8 billion to shareholders through dividends and buybacks, and increased its quarterly dividend 13% to $0.59 per share. With a large operating margin and solid free cash flow in the last fiscal year, Visa maintains a strong financial position and optimistic outlook to lead the future of commerce.

Although it is difficult to know exactly the impact of the new government administration in the US, certain key aspects that the Trump era proposes for the US economy make us think about the key elements in the search for opportunities for our investments. Visa and Microsoft remain two of our favorite ideas heading into 2025. Cedears Criteria’s recommended portfolio maintains 30% of its portfolio between these two value alternatives.

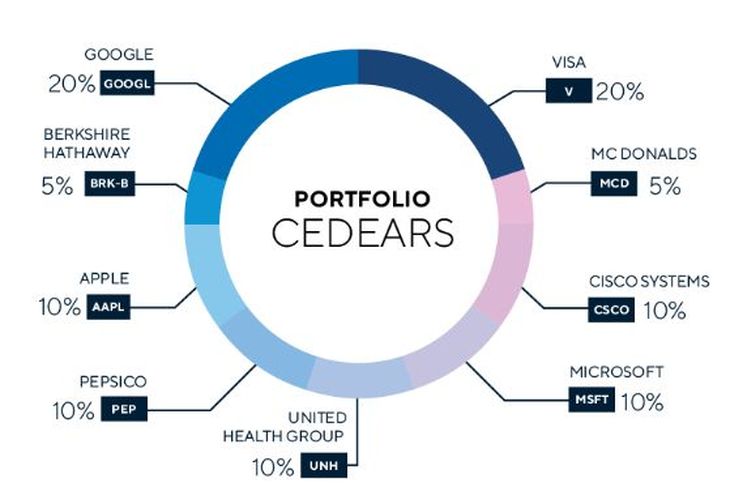

Cedears: portfolio of companies recommended by Criteria

criteria 2.jpg

Criteria Asset Management Analyst

Source: Ambito

I am Pierce Boyd, a driven and ambitious professional working in the news industry. I have been writing for 24 Hours Worlds for over five years, specializing in sports section coverage. During my tenure at the publication, I have built an impressive portfolio of articles that has earned me a reputation as an experienced journalist and content creator.