Despite the Minister’s optimism of Economy, Luis Caputo, in which the reduction of COUNTRY TAX of the 17.5% to 7.5% Starting in September, it will serve to decompress prices, although several studies indicate that the effect may be partial or even null.

First of all, it must be taken into account that lThe causes of the increase in prices in Argentina are not exclusively taxesbut other factors play a role, as is the excess of pesos resulting from the issue to cover the fiscal deficit. In addition to this there is what is called “inertia”, which is the tendency of economic actors to raise prices “a little more, just in case.”

So that isThe reduction of a tax charged on the sale of dollars to pay for imports will have a limited impact in goods that are manufactured in Argentina, the vast majority of which have some imported component for their production.

iaraf-imp-pais.png

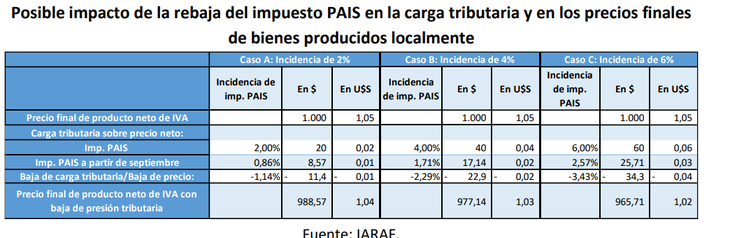

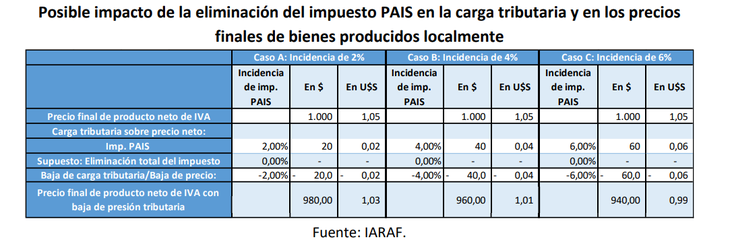

In this regard, the Argentine Institute of Fiscal Analysis (IARAF) He drew up some projections every $1,000 of final priceto the VAT-free based on a hypothesis of integration of 2%, 4% and 6% importsin the case of a partial reduction, and in the case of a 100% elimination of the tax that will occur only in 2025.

For the 10-point reduction in the tax, in the case of goods with an incidence of 2% of imported goods on the final price, the reduction in tax burden would be 1.14%, which means that, for a good with a final price net of VAT of $1,000, the reduction would be $11.4 under the assumption of full transfer to the final consumer.

iaraf.imo-country-2.png

In the case of a incidence of 4% on the final price, the reduction in tax burden would be greater than in the previous case, 2.3%. That is, for a good whose net price of VAT is $1,000, the discount will be $23. Finally, in the case of a product with an incidence of 6% on the final price, the reduction in tax burden would be 3.4%, which would imply a decrease of $34.

Everything will also depend on If the members of the value chain decide to transfer 100% of the reduction to their prices and it is likely that this will not happen, that the companies that manufacture the goods will decide to keep that margin and rebuild their working capital.

The other case is the elimination of the tax planned for 2025, as provided by law. If a good has a 2% import incidence in the final price without VAT, for every $1,000 the reduction would be 2%, which means that for a good with a final price this implies a reduction of $20 under the assumption of full transfer. In the case of a 4% incidence, the reduction in tax burden would be 4% equivalent to $40 and if the product has 6% imports the reduction is 6% equal to $60.

According to IARAF estimatesif the government did not modify the rate and kept the tax as it has been since the beginning of the year, the collection in 2024 would reach 1.13% of GDP.

Therefore, lReducing the tax rate would imply a loss of income from 0.13% to 0.18% of GDP in the last four months of the year. This loss represents between 14% and 20% of the annualized fiscal surplus.

From the Chamber of Importers of the Argentine Republic (CIRA) They say that the impact of the tax reduction and then its elimination will not have an immediate impact. “We will have to wait for a whole cycle to be completed. Although it is a short-term project, the results will be visible within three months,” said a businessman in the sector.

Source: Ambito

I am an author and journalist who has worked in the entertainment industry for over a decade. I currently work as a news editor at a major news website, and my focus is on covering the latest trends in entertainment. I also write occasional pieces for other outlets, and have authored two books about the entertainment industry.