Regarding the expectations of devaluation, they have also been falling from peaks of 120%. On 01/31 they closed at around 90%, at levels similar to those of a month ago. A small difference stands out. On the last day of 2022, the dollar futures curve was flat, while today it has a positive slope, which allows us to assume that the rate of devaluation increase as the months go by. The December position discounts a slightly higher devaluation, perhaps due to the expectation of a change in government or exchange policy, but since it is not traded in large volumes, it is not correct to take it, for the moment, as a general market reference.

For his part, he MEP dollar rose from $327 to $356 (+8.5%), while the CCL it did so from $344 to $370 (+7.5%), despite the announcement of purchases for US$1,000 million by the Central Bank. We do not quite understand why they announced this measure, when they would be buying at parities above 30% (when a month ago they could have bought at 25%), given that the BCRA has few reserves and cannot afford to “spend more”, in a context where the country faces the worst drought in 60 years. Nor did it manage to calm the dollar stock market.

Measured in dollars, hard dollar sovereign bonds managed to recover, especially the shortest ones, with increases of up to 32%. Maybe this was the reason for the announcement, but then Why concentrate purchases in the short section and not in the entire strip?

But if the bonds went up in dollars, why did the MEP go up?

The answer is simple, the increases in pesos were greater.

image.png

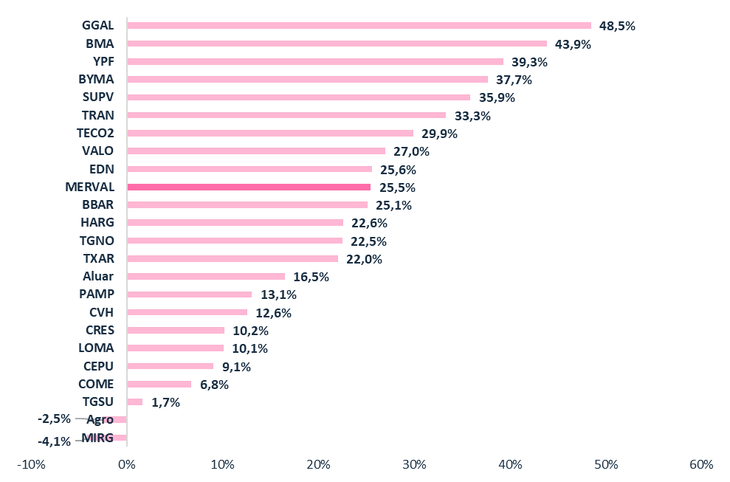

For his part, andhe Merval in pesos it rose 25%, while in dollars it rose 16%, highlighting the rises of banks (which were late), with gains of up to 48.5%.

image.png

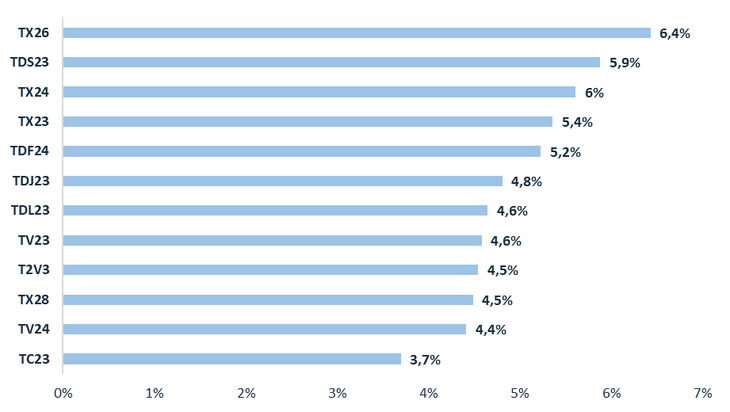

And the dual bonds and CERwhich follow inflation and/or official devaluation, closed with modest gains, similar to the devaluation of the peso and what we estimate will be the variation of the CPI for January, but lost compared to the MEP.

image.png

In conclusion, with a rise in the MEP of 8.5%, only risky assets were able to overcome it. January was not a month for assets in pesos. We had already spoken in previous reports that the carry trade did not have much rein left. Today we confirm it.

What’s next in the markets?

A year of great volatility due to elections, with investors looking for a hedge against inflation and devaluation.

We recommend positioning in dollarized assets such as corporate bonds that pay good annual interest and are not as volatile.

For the more conservative save in dollars (knowing that purchasing power is lost due to inflation in the US).

In short, in Argentina, the dollar is unbeatable, no matter when you read this.

Financial analyst.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.