Q.: Individuals with a very negative balance…

-A lot of money from individuals goes out of the country, obviously they do not have faith in Alberto, nor does this show that there are expectations of an economic change with the new government.

Q.: Does this show us that reserves are going to decline?

-Correct, it is one more example of the lack of dollars.

image.png

Q.: How do we come with the debt to importers?

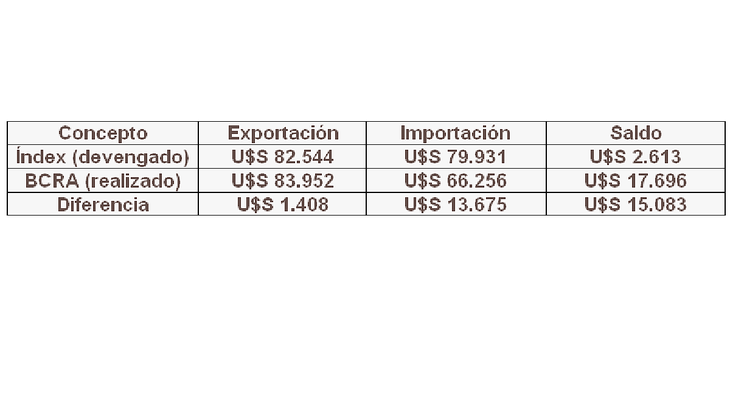

-According to INDEC, in the last 12 months, the balance of the trade balance is positive at US$2,613 million, while what is actually collected and paid by the Central Bank shows us a positive difference of US$17,696 million. .

Q.: How is it understood?

-The Central Bank receives US$1,408 million in advance from exporters, and owes importers US$13,675 million, since it authorizes imports in terms of 90 to 180 days.

image.png

Q.: How many are the reserves?

-Reserves add up to US$32,963 million as of Wednesday, May 24. If imports are paid and export advances are returned, these reserves would be US$17,880 million.

Q.: Are we in trouble?

-The market discounts it as a normal situation.

Q.: How are the monetary liabilities?

-The monetary base is $5.3 trillion and has increased 41.5% in the last 12 months, while remunerated monetary liabilities (leliq and passes) total $14.2 trillion and have increased 159.2% in the last 12 months. The sum of both is $19.5 trillion and increases 111.2% in the last 12 months.

Q.: What are the percentages?

-Of the 100% of monetary liabilities, only 27.2% are the monetary base (it is not remunerated), and the rest 71.8% are remunerated monetary liabilities, if these are not paid and are monetized, inflation goes to the devil.

Q.: How much do you estimate inflation to May 2023?

-We estimate it to May at approximately 115% per year. As you will see, it has been copying the rise in the issuance of all monetary liabilities of the Central Bank, which stands at 111.2% per year.

Q.: How much is the equilibrium dollar?

-The equilibrium dollar is located between $590 and $600, depending on whether you measure it by the partial numbers provided by the Central Bank or by the balances it publishes. This is telling us that a MEP dollar around $460 is a bargain, and a Blue Dollar around $490 is a good price.

Q.: Fixed term?

-For the next two months, a fixed term gives you a return of 16.8%, while if you buy a MEP dollar today you have a potential rise of 28.3%.

Q.: Let’s imagine that you advance US$10,000 million to the Central Bank and bring US$5,000 from China…

-In that case, the reserves would grow to US$48,000 million, of which some pending payments must be made. Let’s imagine that they remain at US$45,000 million. The equilibrium dollar would fall to levels of $430 approximately.

Q.: It’s crazy to buy dollars at these prices…

– Loosen up a bit, the monetary liabilities of the Central Bank are going to grow at a rate of 1.0 trillion per month due to interest payments, they could grow at a higher rate if they continue to implement alternative dollars and they need to issue to pay differences. On the other hand, it continues to be issued to finance the fiscal deficit, which is why it is a never-ending account.

Q.: But would US$15,000 million come in?

Not everything is so linear. For example, the IMF must be paid between now and the end of the year US$7,112 million in capital, and US$1,057 million in interest. In the year 2024, it must be paid US$4,559 million in capital and US$1,505 million in interest.

Q.: If the money from the IMF and China enters, where do you see the dollar?

-If all that money enters, I see the dollar in the zone of $600 by the end of July. I think that total monetary liabilities as of July 31 would be $23 trillion, while reserves (if all the dollars insured by the IMF and China come in) would be $38 billion, that gives us an equilibrium dollar of $605 in the best scenario for the government.

Q.: If the money from the IMF and China does not enter, where do you see the dollar?

I’ll leave that for the private report. Not everything is free.

Q.: Can you tell me what we owe to the IMF?

-I have the data as of December 31, 2022, let’s not fall for ease, the debt for the year 2023 is being rescheduled and will fall in the next administration. If we look at it carefully, what we pay in interest is very little, and what they demand of us is normal, to have a fiscal surplus, which is what any creditor who wants to collect their debt would ask of you.

image.png

Q.: The money that comes in from the IMF goes as it comes…

-It is a revolving door, they lend us and we pay, Argentina has reserves of less than US$ 30,000 million if it pays all the debt to importers, it does not generate its own dollars, therefore, the ticket is going up, until an economic plan is modeled that makes the Argentine public accounts viable.

Q.: What would that plan be like?

-An economic plan that has as its pillars the fiscal surplus, the elimination of the stocks and withholdings. High exchange rate that boosts exports, and generates more investment in the country. If we are lucky and investments in mining and energy prosper, we have two years of good rains to encourage grain and livestock exports. In 18 months after the next government takes office, we may have another scenario of reserves in the Central Bank.

Conclusions:

- The dollar has only one way to rise, however, I would leave us alone if the government gets dollars from China and the IMF.

- The key dates are the trip to China that begins on May 29, and the trip to the United States on June 12. On June 14, a disbursement of US$10,000 million from the IMF would be defined.

- Remember that the Federal Reserve meets on June 13 and 14, and a new rate hike is likely (but not certain).

- For those who speak without knowing. The rains of the last few days only serve to recover the profile of the soil, and encourage the farmer to sow wheat. The losses in soybeans and corn continue to be important and cannot be reversed with these rains. The same happens with livestock, we will have fewer calvings in 2023 and a drop in the number of weanings in 2024. The damage from the drought in the 2022/23 campaign is irreversible, and will generate a drop in GDP of more than 5.0 %. Look at the economic activity, the lack of dollars will be important, but take care of your company or your work.

- The soybean dollar is over, there are versions of the soybean and corn dollar for June, but I leave that for the private report, as well as the expectation of a rise in the stock market.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.