The inheritance you will receive Javier Milei It is catastrophic from all aspects, which include what fiscal, it exchange and the distortion of relative prices. To top it off, the huge ball of Leliq are added Lediv in it Central bank. In this note I tell you everything.

Javier Milei It’s going to have a complicated start with debts that even double those that Kirchnerism left to Mauricio Macri in 2015. How do you explain it? Let’s see:

boggiano 1.jpg

Negative Reserves of the Central Bank: They left it with USD 11,000M of negative reserves. What does it mean? If reserve requirements, bank insurance and the swap with China are subtracted from gross reserves, the numbers turn red. The Central Bank is bankrupt.

Central Bank Debts: Between Dollar and Lediv futures, the BCRA has commitments of almost USD 10,000M (to the official dollar). The Lediv became relevant in recent days, when the stock increased drastically. They are bills that are subscribed in pesos and are tied to the official dollar. What does this imply? If Javier Milei normalizes the exchange market, the BCRA will have to pay a rate of 100% to face all this debt, which implies practically issuing a new monetary base. It really is a criminal bomb.

National Treasury Debts: The National Treasury faces significant maturities due to debts linked to the official dollar and bonds that are adjusted according to the price index or the evolution of the exchange rate, totaling around USD 20,000M.

Debt for the YPF trial: In addition, there is a million-dollar lawsuit, related to the expropriation of YPF, which totals USD 16,000M.

Debt with companies: The commercial debt of private companies amounts to USD 30,000M, between pending dividends and debts with foreign suppliers.

In summary, all of this represents a total burden estimated at more than USD 86 billion for the next government, double the situation inherited by the previous government in 2015. These imbalances could trigger a significant economic crisis if not properly managed.

Other “bombs” that Massa leaves

Outside of the enormous number of commitments that the new government has to solve, there are other heavy legacies.

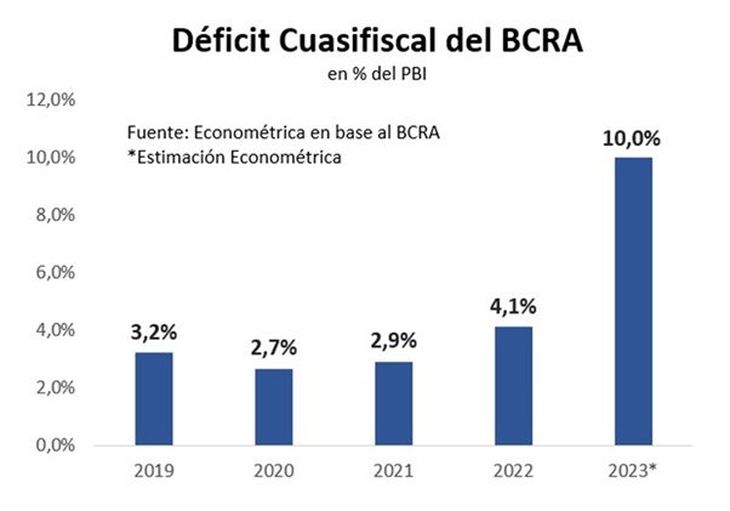

On the one hand, the fiscal deficit, the origin of all Argentine crises, remains critical, greater than 5%. And the most serious thing is the quasi-fiscal deficit:

deficit bcra.jpg

The daily interest payments of the Leliq are causing a significant impact on the issuance of money and, therefore, on inflation. This generates a quasi-fiscal deficit of 10% of GDP which, together with the National Treasury deficit, exceeds 15% of GDP.

It is important to note that a fiscal deficit of this magnitude, where the quasi-fiscal deficit exceeds that of Treasure, It has already been seen in 1975 before a period of economic adjustment and in 1989 before hyperinflation.

Of the last 63 years, in 57 it was spent beyond possibilities. Therefore, fiscal balance is extremely important. Let us remember Massa’s “Platita Plan”, which exceeded 1% of GDP and left the fiscal deficit above the 1.9% agreed with the IMF.

Furthermore, inflation is totally out of control. In Massa’s administration as Minister of Economy alone, it rose by 193%, and the food sector by 208%, affecting those who have the least the most. These figures occurred even though there is a phenomenal freezing of prices for food, fuel, electricity and gas rates, public transportation, among others. Therefore, there is a lot of “repressed inflation.” Another bomb.

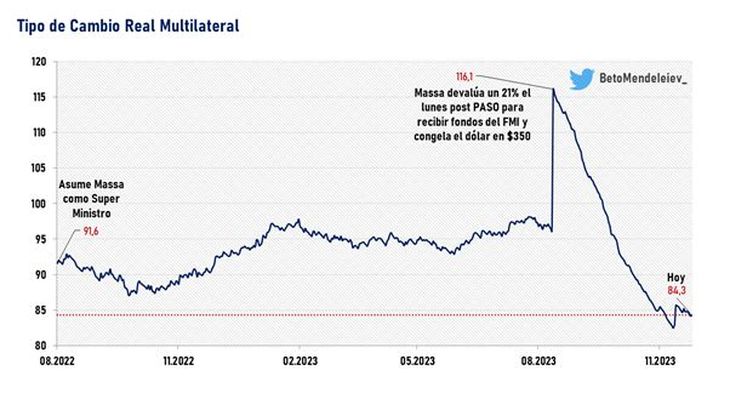

Regarding the exchange rate, the situation is dramatic. Since Massa took office, free dollars (MEP, Cash with Liquidation and blue) have risen approximately 200%. And the officer is artificially depressed:

boggiano 2.jpg

After having devalued post STEP, the devaluation effect was quickly consumed. Because? Because the dollar was fixed at $350 and the acceleration in inflation “ate it up.” The level of delay is phenomenal and the market discounts (through dollar futures) a new devaluation when Javier Milei takes office.

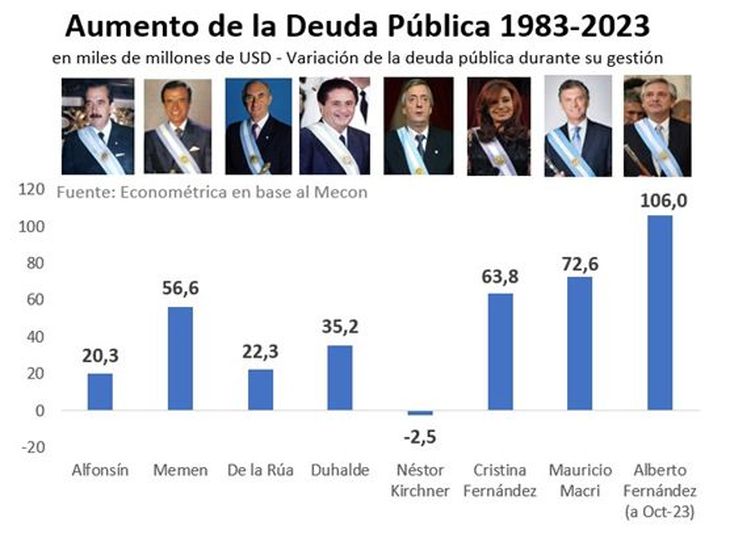

Furthermore, let us remember that Alberto Fernández’s government borrowed USD 106,000M, even though the majority was in local currency. He broke all records:

boggiano 3.jpg

To make matters worse, the social situation is very delicate, with 40% of the population living in poverty, which has been increasing in recent years.

Javier Milei will have a huge task to try to stabilize the country and achieve a reliable plan that gives him good prospects. Without a doubt, it will be a complicated and long road.

Are you interested in knowing more about these topics? I want to invite you to read a report that I prepared with the 22 best finance and investment sites. It is information that in many cases is difficult to find. You can download it at this link.

Note: The material contained in this note should NOT be interpreted under any circumstances as investment advice or a recommendation to buy or sell a particular asset. This content is for educational purposes only and represents the opinion of the author only. In all cases it is advisable to seek advice from a professional before investing.

CEO of Carta Financiera

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.